| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy ate ment | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under §240.14a-12 | |

| ☒ | No fee | |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ☐ | Fee paid previously with preliminary | |||

| ☐ |

| |||

KIRBY | 2023 PROXY STATEMENT | PROXY SUMMARY | 1 |

TABLE OF CONTENTS

| ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 18 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

2 |

| |||

KIRBY | 2023 PROXY STATEMENT

| ||||

March 5, 2020

On behalf of the Board of Directors (the “Board”), we cordially invite you to attend Kirby Corporation’s 2020(“Kirby” or the “Company”) 2023 Annual Meeting of Stockholders. Information concerning the matters to be voted upon at the meeting is contained in this Notice of the 20202023 Annual Meeting and our Proxy Statement.

Looking backKirby saw positive momentum and improved market fundamentals across both business segments despite a challenging start to 2022 due to lingering effects of the COVID-19 pandemic and its variants. In addition to this, record low water and macro-level headwinds, including labor constraints and inflationary pressures, created further headwinds. Nonetheless, we stayed focused on 2019,the things we could control, and as the year can be characterizedprogressed, our markets and financial performance improved. Our core values of “No Harm to People, No Harm to Equipment, and No Harm to the Environment” continued to guide our Company and our hard-working and dedicated team executed toward these goals. We exited the year in a stronger position than we began and look forward to continuing to improve on our financial results.

In the marine transportation segment, the year began significantly challenged by very differentthe COVID-19 Omicron variant, resulting in crewing challenges, lost revenue, and increased operating costs. Despite this tough start to the year, we began to see market conditions in each of our core businesses. Ininland marine transportation, although inland operations were challenged by historic flooding onimprove in the Mississippi River System, improvingsecond quarter with refinery and petrochemical utilization ramping up and increased volumes from new petrochemical plants that led to increased barge utilization. With this higher business activity and tighter market conditions, spot and term contract pricing steadily increased. In our recent investments in the inlandcoastal business, we also saw positive growth with improved customer demand leading to increased barge utilization and coastal fleets contributed to significant year-on-year growth in revenues and operating income. This was offset, however, by the impact of a cyclical downturn in our oil and gas related distribution and services businesses. Overall, the Company generated significant free cash flow which was used to fund growth in inland marine and pay down debt.rates.

In marine transportation, we continue to make strategic investments to improve the efficiency and average age of our fleet. In March 2019, we completed the purchase of Cenac Marine Services, LLC’s (“Cenac”) young marine transportation fleet including 63 inland tank barges, 34 inland towboats, and two offshore tugboats. We also invested in new modern horsepower, delivering seven new inland towboats, two of which were constructed in our own shipyard, as well as three new state-of-the-art coastal tugboats. These investments, together with the commencement of operations for our new 155,000 barrel coastal articulated tank barge, have strengthened Kirby’s fleet in our core markets and will enhance future profitability and stockholder returns.

In distribution and services, significant reductionswe saw a year of meaningful improvement with favorable oilfield fundamentals and strong demand in oilfield activity and customer spending in North America resulted in a challenging year for this segment. In response, we took decisive actions to lower our cost structure, reduce working capital, and streamline our oil and gas related businesses so that we will emerge from the downturn as a stronger and more efficient company. Beyond oil and gas, our commercial and industrial portfolio hadmarkets. Supply chain issues and long lead times persisted throughout the year, but demand for our products and services continued to steadily increase, with increasing new orders and a stronggrowing sizable backlog. We believe this momentum will carry on into 2023 and 2024 as the Company expects demand for new environmentally friendly pressure pumping and e-frac power generation equipment to remain strong.

During the year, with growthKirby announced the development of its inland marine hybrid electric towboat. Kirby will be one of the first, if not the first, inland marine transportation companies to own and operate a diesel-electric hybrid towboat in the power generation, marine, and on-highway sectors. These diverse businesses are poised for further growth in the coming years and provide a base of stable financial performance.

InUnited States which will move bulk liquid crude oil or refined petroleum products. This project furthers our Corporate functions, 2019 was a busy and successful year, with numerous projects completed which strengthen Kirby for future success, including: critical enhancementscommitment to our information technologysustainability goals and cybersecurity infrastructure; implementationvalues and will support our customers in meeting their carbon emissions reduction targets as well. In 2022, we realized that due to business activity levels in 2021, our emissions reduction target would be met sooner than expected. Thus, we went back to the drawing board to reassess our near and long-term goals. In the summer of 2022, with Board approval and executive management oversight, we decided to set a new target of a 40% emissions reduction by 2040. Sustainability has been a part of Kirby’s culture for many decades, and I’m proud that we continue to meet milestones and commit to new payrollones.

The Board and benefits tracking system;management team are confident in Kirby’s prospects for continued profitable growth and improvedvalue creation, as underscored by our strong financial flexibility through an increaseresults and operating performance in 2022. As we move into 2023, I am encouraged by the term and size of our bank credit facility. At the Board level, we enhanced the experience and capabilitiespositive prospects of the Board with the election ofCompany’s two business segments. As always, we remain cautiously optimistic as recessionary headwinds and monetary policy could create an uncertain economic environment. I want to thank our tenth director, Tanya S. Beder. Ms. Beder brings a wealth of professional, financial,employees and academic experience, asstockholders for supporting Kirby this year. We ended 2022 on solid footing and are well as critical operational and risk management knowledge whichpositioned for what we believe will be invaluable to Kirby in the years ahead. We ask that you support the nomination of Ms. Beder in this year’s proxy vote.a positive 2023.

Your vote is important to us, regardless of the number of shares you hold or whether you plan to personally attend the meeting. Once you have reviewed the proxy materials and have made your decision,decisions, please vote your shares using one of the methods outlined in the Proxy Statement.

Thank you for your continued support and for investing in Kirby Corporation.

| Sincerely,

DAVID W. GRZEBINSKI President and Chief Executive Officer |

KIRBY | 2023 PROXY STATEMENT | ||

3 |

OF STOCKHOLDERS

Dear Fellow Stockholders:

|

| |||

| On behalf of the Board of Directors, we cordially invite you to attend the

| ||||

| Proposals to be voted on at the Kirby Corporation

| ||||

| 1. | Election of

| |||

| 2. |

| |||

Ratification of the Audit Committee’s selection of KPMG LLP as Kirby’s independent registered public accounting firm for

| ||||

Advisory vote on the approval of the compensation of Kirby’s named executive officers. | ||||

| ||||

| ||||

You have the right to receive this notice and vote at the Annual Meeting if you were a stockholder of record at the close of business on March 1, 2023. Please remember that your shares cannot be voted unless you sign and return a paper proxy card, vote during the Annual Meeting, or vote your shares via the phone or internet. All participants who attend the Annual Meeting will be allowed to ask questions to management during the meeting.

Important Notice Regarding the Availability of Proxy Materials for Our 2023 Annual Meeting of Stockholders

We are pleased to take advantage of Securities and Exchange Commission (the “SEC”) rules that allow us to furnish our proxy materials, including this Proxy Statement, a proxy card or voting instruction form, and our Annual Report on Form 10-K (collectively, the “Proxy Materials”), over the Internet. As a result, we are mailing to most of our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of paper copies of the Proxy Materials. The Notice contains instructions on how to access those documents over the Internet and how to submit your proxy via the Internet. The Notice also contains instructions on how to request a paper copy of the Proxy Materials. All stockholders who do not receive the Notice will receive a paper copy of the Proxy Materials by mail or an electronic copy of the Proxy Materials by e-mail. This process allows us to provide our stockholders with the information they need in a timelier manner, while reducing the environmental impact and lowering the costs of printing and distributing the Proxy Materials. The Notice is first being sent to stockholders and the Proxy Materials are first being made available to stockholders at www.proxydocs.com/KEX on or about March 14, 2023.

Your Vote isIs Important

Your vote is important. Whether you intend to attend the meeting or not, please ensure that your shares will be represented by completing, signing, and returning your proxy card, in the envelope provided, or by voting via the phone or internet.

|   |   |   | |||||

| Telephone | Internet | Fill out your proxy card and submit by mail. |

Sincerely,

AMY D. HUSTED

Vice President, General Counsel and Secretary

4 | ||

KIRBY | | ||

This booklet contains the notice of the Annual Meeting and the Proxy Statement, which contains information about the proposals to be voted on at the meeting, Kirby’s Board of Directors and its committees, and certain executive officers. This year you are being asked to:

| 1. | Elect |

| 2. |

|

Ratify the Audit Committee’s selection of KPMG LLP as Kirby’s independent registered public accounting firm for |

Cast an advisory vote on executive compensation. |

General Information

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors of Kirby Corporation to be voted at the Annual Meeting of Stockholders to be held at Kirby’s Houston offices, 55 Waugh Drive, 11th Floor, Houston, Texas 77007, on April 28, 2020,25, 2023, at 10:00 a.m. (CDT). Stockholders of record at the close of business on March 1, 2023, will be able to attend the 2023 Annual Meeting at Kirby’s executive offices located at 55 Waugh Drive, Suite 1100, Houston, Texas 77007.

The mailing address of Kirby’s principal executive offices is P.O. Box 1745, Houston, Texas 77251-1745 and the office number is 713-435-1000.

Whenever we refer in this Proxy Statement to the Annual Meeting, we are also referring to any meeting that results from an adjournment or postponement of the Annual Meeting.

Unless the context requires otherwise, the terms “Kirby,” “the Company,” “our,” “we,” “us,” and similar terms refer to Kirby Corporation, together with its consolidated subsidiaries.

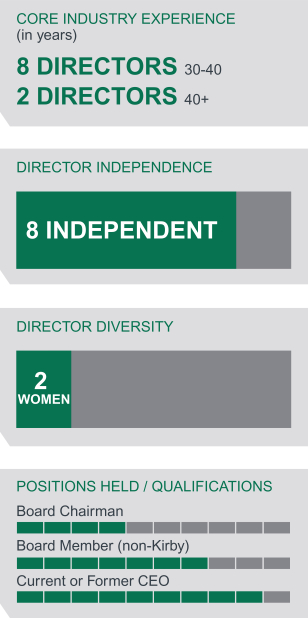

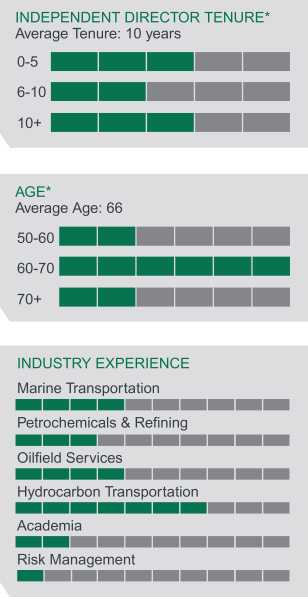

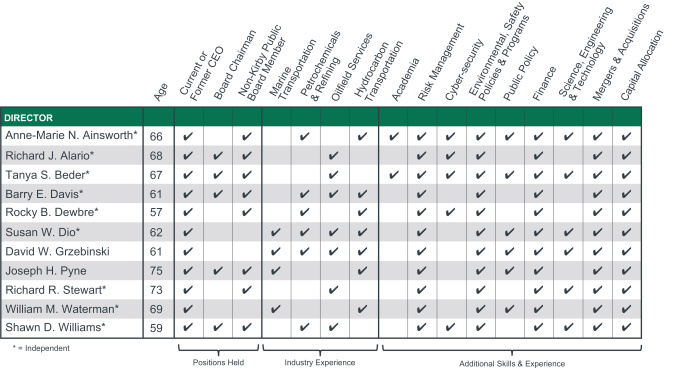

BOARD COMPOSITION & EXPERIENCE

The following matrix displays the most significant skills and qualifications that each Director possesses. The ESG and Nominating Committee reviews the composition of the Board as a whole periodically to ensure that the Board maintains a balance of knowledge and experience and to assess the skills and characteristics that the Board may find valuable in the future and in the long-term interest of stockholders.

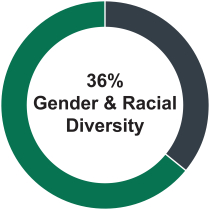

The Board seeks to achieve diversity and recognizes the importance of Board refreshment to ensure that it benefits from fresh ideas and perspectives. The following charts illustrate the Board’s continued commitment to diversity of backgrounds and Board refreshment.

*As of March 2020

|  |

|

6 | ||

PROXY | ||

KIRBY | 2023 PROXY STATEMENT |

2019 BUSINESS HIGHLIGHTS2022 FINANCIAL SUMMARY

In 2019, consolidatedConsolidated revenues declined 4%increased 24% in 2022 to $2.84$2.78 billion. The reductionyear-over-year improvement was driven by a 16% decreaseincreased demand and improved pricing in revenuesthe marine transportation business and higher activity levels in the distribution and services segment,segments. Net earnings attributable to Kirby were $2.03 per share in 2022.

Marine transportation revenues increased 22% to $1.62 billion during 2022. The strong growth was primarily due to a 27% increase in inland marine revenues driven by higher barge utilization and increased term and spot contract pricing. Inland market conditions steadily improved throughout 2022 even though the first quarter was impacted by the COVID-19 Omicron variant, which caused crew challenges and reductions in customer volumes. In the second quarter, inland market conditions improved significantly with sequential increases in spot rates and strong year-over-year increases in term contract rates. Healthy market demand and a limited supply of available barges improved utilization to the low 90% range supporting further price increases in the third quarter. Market fundamentals continued to improve sequentially and year-over-year in the fourth quarter, but weather, including low water conditions in the Mississippi River and navigational delays were a headwind to fourth quarter earnings. Despite the increase in delay days and rising fuel costs, fourth quarter margins improved to the low teens and exited the year at the highest levels since 2020. The inland market is expected to remain strong in 2023, driven by steady growth in activity, minimal new barge construction, and continued gains in pricing.

In coastal marine, revenues increased 7% year-over-year as coastal market conditions modestly improved throughout the year. In the first quarter, the coastal business was partially offsetalso impacted by the COVID-19 Omicron variant, as well as reduced coal shipments. Coastal marine returned to profitability in the second quarter with low single digit margins due to a 7%combination of cost savings actions and modest price increases. In the third quarter, market conditions improved further with improvements in utilization and pricing. The fourth quarter was marginally impacted by unfavorable weather conditions and planned maintenance. Overall, coastal barge utilization remained strong throughout the year and both spot and term contract pricing improved year-over-year.

In distribution and services, revenues increased 26% year-over-year and operating margins improved to 5.7%, led by improved oilfield activity and a robust economy. In oil and gas, increased rig counts and fracturing activity ultimately contributed to a 49% increase in revenues, in the marine transportation segment. Growth in the marine transportation segment was primarily related to the inland acquisition of Cenac’s marine transportation fleet in March, improved market conditions and pricing in inland and coastal, and higher barge utilization in coastal. In the distributionincluding increased demand for new transmissions, engines, parts, and services segment, the revenue decline was driven by a cyclical downturn in the oil and gas market which resulted in reducedour distribution business. The manufacturing business also significantly benefited from new orders for new and remanufacturedKirby’s extensive portfolio of environmentally friendly pressure pumping equipment as well as lower demandand power generation solutions for electric fracturing, although global supply chain constraints did delay some equipment sales, service, and parts. This was partially offset by growth in thedeliveries. In commercial and industrial, market, particularlythe strong US economy contributed to increased revenues and demand for Kirby’s marine repair, on-highway, and power generation products and services. Demand for Thermo King refrigeration equipment remained steady throughout the sale of back-up power systems in power generation.year. Further, our online parts marketplace, www.dieseldash.com, which launched last year, continues to see strong growth.

Despite the overall revenue reduction, operating income, excluding one-time items1, increased 5% to $282.3 million, with strength in marine transportation and cost reduction efforts in distribution and services more than offsetting the adverse impacts of reduced oilfield-related revenues. Earnings per share, excluding one-time items1, increased modestly to $2.90.

In 2019,From a balance sheet perspective, Kirby generated $512$294 million in cash flow from operations. This cash flowoperations in 2022 which was used to fund capital expenditures and significantly pay down debt. Capital expenditures were tightly managed but increased approximately 75% compared to 2021 due to higher levels of activity and deferred spending in 2020 and 2021. Throughout the year, the Company remained committed to reducing debt and make additional investments in the marine transportation fleet. During the year, Kirby invested more than $300repaid over $84 million in acquisitions and new construction of marine equipment, including 64 inland barges representing 1.9 million barrels capacity, 41 inland towboats, and five coastal tugboats.debt. At the end of 2019,2022, Kirby’s total long-term debt balance was $1.37had declined to $1.08 billion, representing a reduction of more than $40 million compared to 2018, with athe debt-to-capitalization ratio improving to 26.2%. Kirby also returned capital to shareholders by buying back 386,000 shares in 2022 at an average price of 28.9%.$59.32.

|

KIRBY | 2023 PROXY STATEMENT | |||

PROXY SUMMARY | |||

7 |

The Board represents the stockholders’ interest and is responsible for overseeing Company management, includingwhich includes monitoring the effectiveness of management practices and decisions.decisions, corporate performance, the integrity of the Company’s financial controls, and the effectiveness of its enterprise risk management programs. To that end, the Board has established governance practices including the guidelines and charters described below.below which are reviewed by the Board at least annually and changes are made as necessary.

Risk Oversight

The Board is responsible for the risk oversight function and has designated the Audit Committee, the Compensation Committee, and the ESG and Nominating Committee certain responsibilities to provide assistance in fulfilling the Board’s responsibilities. A particular risk will be monitored and evaluated by the Board committee with primary responsibility in the area of the subject matter involved. For example, the Compensation Committee reviews the risks related to the Company’s compensation policies and practices and the Audit Committee receives regular reports and updates on cybersecurity issues. See page 25 for further detail on risk oversight by the Board and its committees.

Business Ethics Guidelines

The Board has adopted Business Ethics Guidelines that apply to all directors, officers, and employees of the Company.Company, including the Company’s chief executive officer, chief financial officer, chief accounting officer or controller, or persons performing similar functions. A copy of the Business Ethics Guidelines is available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Governance/Governance Overview.Documents. The Company is required to make prompt disclosure of any amendment to or waiver of any provision of its Business Ethics Guidelines that applies to any director or executive officer including its chief executive officer, chief financial officer, chief accounting officer or controller, or persons performing similar functions. The Company will make any such disclosure that may be necessary by posting the disclosure on its website at www.kirbycorp.com in the Investor Relations section under Governance/Governance Overview.Documents.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines. A copy of the guidelines is available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Governance/Governance Overview.Documents.

Communication with Directors

Interested parties, including stockholders, may communicate with the full Board or any individual directors,director, including the Chairmen of the Audit, Compensation, and Governance Committees, the presidinglead independent director or the non-management or independent directors as a group, by writing to them c/o Kirby Corporation, P.O. Box 1745, Houston, Texas 77251-1745. The Company will refer the communication to the appropriate addressee(s). Complaints about accounting, internal controls and accounting controls or auditing matters should be directed to the Chairman of the Audit Committee at the same address. All communications will be forwarded to the person(s) to whom they are addressed.

Website Disclosures

The following documents and information are available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Governance/Governance Overview:Documents:

Audit Committee Charter

| • | Audit Committee Charter |

Compensation Committee Charter

| • | Compensation Committee Charter |

Governance Committee Charter

| • | ESG and Nominating Committee Charter |

Criteria for the Selection of Directors

| • | Criteria for the Selection of Directors |

Business Ethics Guidelines

| • | Business Ethics Guidelines |

Corporate Governance Guidelines

| • | Corporate Governance Guidelines |

| • | Communication with Directors |

Communication with Directors

| • | Clawback Policy |

| • | Insider Trading Policy |

8 | ||

PROXY | KIRBY | 2023 PROXY | |

| STATEMENT |

Our Board prides itself on its commitmentis committed to highthe highest ethical standards, effective governance practices, diversity, and leveraging its expertise withinin the industries in which we operate.Kirby operates. The Board seeks to achieve a mix of directors that represent a diversity of background and experience, including with respect to gender and race. The Board’s focus on diversity prioritizes differences in viewpoint, professional experience, education, skill, and other qualities and attributes that contribute to the Board’s overall effectiveness. The Board acknowledges that the current policies of several of its key stakeholders require a minimum number of female board members. The Company takes such policies into consideration when considering director appointments.

In October 2019,Further to these efforts, in early 2023, the Board was expanded from ninecontinued to ten directors and enhanced withenhance its structure through the election of Tanya S. BederMs. Susan Dio and Mr. Rocky Dewbre as the tenth director.its newest members. Ms. Beder’s extensive background in professional, board, and academic disciplines, as well as her wealthDio has more than 25 years of experience in assetinternational refining, petrochemicals, oil and risk management, finance,gas and data analytics will be immensely valuable to Kirby’s future success.marine transportation. Mr. Dewbre has over 20 years of executive and board experience in public and private businesses in the energy, fuel distribution, and multi-unit sectors.

| TOPIC | PRACTICE | |

| Independence | • | |

• Board committees are composed entirely of independent directors | ||

| Lead Independent | • Richard J. Alario serves as the Lead Independent | |

| Diversity | • | |

| Executive Sessions | • Non-management directors meet regularly without management | |

| Majority Voting | • Majority of votes cast is required for the election of directors | |

| Director Evaluations | • Evaluations of the full board and each committee are conducted annually | |

| Stock Ownership | • Stock ownership guidelines established for directors and executive officers | |

| Single Voting Class | • Kirby has a single class of voting stock | |

| Hedging and Pledging of Stock | • Hedging and pledging of | |

| Business Ethics Guidelines | • Ethics guidelines apply to all our directors, officers, and employees | |

| Clawback Policy | • We have a clawback policy in place for executive officers | |

| Insider Trading Policy | • Our insider trading policy applies to all our directors, officers, and employees, with a supplemental policy applicable to directors, executive officers and certain key employees | |

| Board Oversight | • The ESG and Nominating Committee oversees climate-related risks and the Environmental, Social, and Governance program on a quarterly basis. Assists the Board in fulfilling its oversight of risks that may arise in connection with the Company’s governance practices and processes. Discusses risk management in the context of general governance matters, including topics such as Board succession planning to ensure desired skills and attributes are represented. • The Audit Committee oversees the risk management, employee hotline/ whistleblower, and cybersecurity programs and processes on a quarterly basis to evaluate the Company’s risk exposure and tolerance. • The Compensation Committee assists the Board in fulfilling its oversight of risks that may arise with the Company’s compensation programs and practices. Reviews executive compensation which is designed to promote accountability to maximize stockholder value over the long term. | |

KIRBY | 2023 PROXY STATEMENT | |||

PROXY SUMMARY | |||

9 |

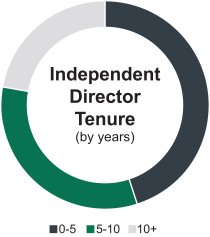

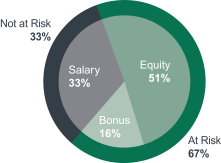

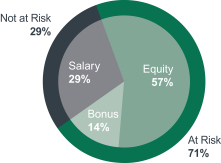

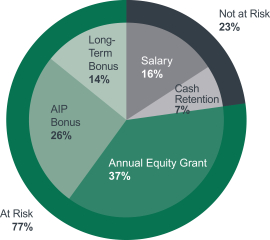

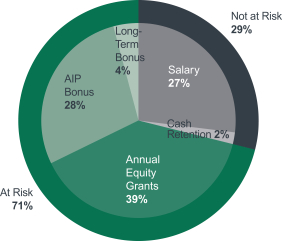

Our executive compensation philosophy has been consistent and focused on the creation of value for our stakeholders. A significant portion of our named executive officers’ compensation is tied to “At Risk” or pay-for-performance components. The pie charts belowon the following page depict how each element of compensation was weighted for our named executive officers in 2019.2022.

Our executive compensation program is designed to attract and retain talented executive officers, motivate consistent performance over time, and encourage performance that results in increased profitability and stockholder returns. Our executive compensation program has historically received high levels of stockholder support, generally coming in well above 90%. InHowever, in 2018 while thereand 2019, stockholder support declined and some investors voiced concerns over certain elements of the program, including the use of similar pay-for-performance metrics in both the short-term and long-term plans. These concerns were no materialaddressed in 2021 and 2022 with changes implemented to ourdifferentiate the metrics in these plans, including adding a safety, operations, and ESG component to the short-term plan. The below table outlines the changes:

Prior Metrics | 2021 and 2022 Metrics | |

Short-Term Earnings per share – 33.3% Return on total capital – 33.3% EBITDA – 33.3% | Short-Term Earnings per share – 40% EBITDA – 40% Operating Performance/ESG – 20% | |

Long-Term Performance Awards Earnings per share – 33.3% Return on total capital – 33.3% EBITDA – 33.3% | Long-Term Performance Awards Return on total capital – 50% EBITDA – 50% |

Starting in 2021, we also eliminated the issuance of stock options in the executive compensation program, the approval rating declined at the 2019 Annual Meeting as a result of some stockholders voting against a one-time special retirement payment granted by the Board of Directors toplan, and our former Executive Chairman. For 2019, we did not have any special one-time payments, and the core of our executive compensation program remained unchanged.clawback policy became effective January 1, 2021. Listed below are some of the highlights of our compensation policies and practices:

|

| |

| Pay-for-Performance Focus | • Performance-based cash annual incentive compensation rewards current year financial and operational success | |

• Performance-based cash and equity long-term incentive awards incentivize future growth and profitability | ||

| ||

| AnnualSay-on-Pay Vote | • We annually ask stockholders to provide an advisory vote on executive compensation | |

| Equity Ownership Guidelines | • Stock ownership guidelines are established for executive officers | |

• CEO stock ownership requirement of 5x salary | ||

| Independent Compensation Consultant | • The Compensation Committee has retained a nationally recognized compensation consulting firm to serve as its independent compensation consultant | |

| Double-Trigger Vesting | • We have adopted double-trigger vesting of equity awards upon a change in control | |

| Clawback Policy | • We have a clawback policy in place for executive officers | |

| Excise Tax Gross-Ups | • We do not provide executive officers with excise taxgross-ups | |

| Re-pricing Stock Options | • We do not buy out or exchange underwater options, or re-price stock options | |

| Evergreen Equity Plans | • We do not have any plans | |

10 |

PROXY SUMMARY |

KIRBY | 2023 PROXY STATEMENT | ||

|

COMPENSATION

COMPENSATION

PRESIDENT AND CEO |  OTHER NEO | |

TOTAL COMPENSATION |  TOTAL COMPENSATION | |

|  | |

NOTE: Includes total direct compensation as referred to in the compensation discussion and analysis on page 29. “Bonus”34 and cash retention awards. “AIP Bonus” includes non-equity annual incentive plan compensation. “Long-Term Bonus” includes non-equity payments for the 2020-2022 performance period under the long-term incentive compensation program. “Cash Retention” includes the retention awards granted to Messrs. Grzebinski and O’Neil as discussed on page 36. Performance-based variable compensation is deemed “At Risk.” For additional information, reference the Summary Compensation Table on page 36.46.

KIRBY | 2023 PROXY STATEMENT | |||

PROXY | |||

11 |

Throughout 2019, senior management and investor relations engaged with our stockholders and potential stockholders on a regular basis to share information on the Company, listen to their perspectives, and solicit feedback. In 2019, we conducted nearly 200 phone calls and in-house one-on-one meetings which connected us to more than 250 investors and analysts. We attended 12 equity conferences and investor events across the United States, and we hosted several investor events at our key operating facilities in Houston and Oklahoma City.

In October, Kirby’s executive management team hosted our top 50 stockholders and sell-side analysts at a reception with the Board of Directors in New York City. This event was well attended and provided our top stockholders with a valuable opportunity to engage with the Board and the Company’s executive leadership.

Kirby has a long history of promoting sustainability as part of our corporate culture,strong and our “NO HARM” principles – NO HARMlong-standing commitment to People, to the Environment, and to Equipment is the foundation of our culture. We view sustainability as integral to the continued advancement of our NO HARM culture and strive to integrate it as part of our business strategy. Kirby’s core values of responsible operation, valuing our employees, and acting as stewards of the environment in the communities we operate shape our initiatives and strategies. Kirby has a long-standing history of investing in new equipment and technologies that improve its operations and support its environmental stewardship initiatives. We support our employees through extensive training and development programs, and continuously emphasize our high safety standards.

During 2019, we took concrete steps to improve our sustainability disclosures. In our 2019 Sustainability Report, we provided historical safety statistics which disclose our record on employee injuries, harm to equipment, and cargo spills to the environment. This report is available on the Company’s website at www.kirbycorp.com in the Sustainability section under ESG Presentation. Additionally, we provided new disclosures on our safety programs, management and audit oversight, and best practices which we utilize in operations every day. We also expanded our reporting on social matters, including enhanced disclosures on our employee benefit programs and community involvement. Additionally, we expanded the oversight of our sustainability program beyond executive leadership to include the Board of Directors. Our Governance Committee charter now includes environmental, social and governance (“ESG”) oversight. Finally,ideals which serve as the foundation to its culture and core values. Kirby’s core values are embedded in its “No Harm” objectives: “No Harm to People, No Harm to Equipment and No Harm to the Environment.” Treating our employees well, supporting the communities in which we added dedicated employee resourcesoperate and respecting the environment are not just good for business, but they are the right thing to further enhance our disclosuresdo. Despite the challenges of disruptions caused by COVID-19 variants and improve our engagementabnormal operating conditions due to historic low water conditions on the Mississippi River, the Company continued focusing on its ESG initiatives.

In 2022, the Company continued to advance its ESG objectives. With executive management and Board level oversight, Kirby developed its first short term carbon emissions reduction goal in 2020. The 2020 emission reduction goal was met early principally due to the decline in business activity. In 2022, the Company raised the bar by aiming to have a 40% reduction of carbon emissions per barrel of capacity by 2040.

At the moment, the Company is developing many approaches to achieve this new objective. Testing out alternative fuels, finding operational efficiencies, and investing in new technologies are a few initiatives the Company is exploring to accomplish its targets. Kirby will be one of the first, if not the first, inland marine transportation companies to own and operate a diesel-electric hybrid towboat in the United States moving bulk liquid crude oil or refined petroleum products. This design was created in house with ESG stakeholders.

partnership between two of the Company’s wholly owned subsidiaries, Stewart & Stevenson and San Jac Marine, Kirby’s own shipyard. The Company anticipates that the vessel will be ready for service in 2023. It will operate in the Houston Ship Channel using shoreside recharging stations at the Company’s marine facilities. Kirby is proud of this project and is encouraged by the customer feedback and support. In 2020, a key focusaddition, all of Kirby’s marine transportation facilities in Texas are powered by renewable energy. Thus, when the hybrid electric towboat is to provide new disclosures on Kirby’s greenhouse gas emissions. Werecharging, the source will also be working to align our ESG disclosures with the Sustainability Accounting Standards Board frameworkgreen energy and the Task Force on Climate-Related Disclosures.anticipated emissions savings could be up to 80% when compared to comparable towboats with conventional engines.

To learn more about these programs and initiatives, please visit the Corporate Sustainability section of our website at www.kirbycorp.com.

12 | ||

PROXY SUMMARY | KIRBY | | |

TABLE OF CONTENTSSTAKEHOLDER ENGAGEMENT

The Board and management believe ongoing engagement with our stockholders is vitally important and understand the importance of keeping stockholders informed about the business, understanding stockholders’ perspectives, and addressing stockholders’ areas of interest. Kirby’s executive and management teams understand that the Company must engage to make sure its value is fully recognized by its stakeholders. In addition, it is equally important that stakeholders know their concerns are understood and considered by management. Following disruptions due to the pandemic and the need for virtual meetings, the Kirby Investor Relations team was able to proactively engage with stockholders in person in 2022. The team met with over 75% of our 25 largest shareholders (by share ownership) at some point during the year. While some conferences were still attended virtually, our management team was able to get out on the road attending conferences and having non-deal roadshows in person. We take pride in our facilities and operations and as such, the Company conducted tours for investors at some of our primary business locations. We believe being able to showcase these offerings after a few years of virtual experiences was highly impactful. The Company held an investor reception in October in New York City following its earnings release and held a Company update which also had an ESG focus and facility tour in December. Both events were well attended and allowed investors to engage with our executive and management teams.

Stakeholder engagement extends beyond the investment community. At Kirby, the Company is committed to listening to all participants across our industries to best understand our customers and communities in which we operate. Involvement and interaction are not limited to meetings or tours of facilities. In several of Kirby’s departments, employees serve and lead committees or boards that impact the work we do.

Engaged with: | Engaged through: | Engagements include: | ESG Engagements: | |||

✓ Institutional Investors ✓ Nongovernmental Organizations ✓ Proxy Advisory Firms ✓ ESG Rating Firms | ✓ Individual and Group Investor Meetings ✓ Company Update and Facility Tour ✓ Quarterly Earnings Calls ✓ Investor Conferences ✓ Annual Stockholder Meeting ✓ Stockholder Webcasts ✓ Stakeholder Outreach | ✓ CEO / CFO ✓ Lead Independent Director ✓ Senior Management ✓ Subject Matter Experts ✓ Other Employees | ✓ 20+ meetings represent over 75% of top 25 largest shareholders ✓ ESG-focused governance calls |

KIRBY | 2023 PROXY STATEMENT | ||

VOTING ITEM 1:

ELECTION OF DIRECTORS

The Bylaws of the Company provide that the Board shall consist of notno fewer than three nor more than fifteen members and that, within those limits, the number of directors shall be determined by the Board. The Bylaws further provide that the Board shall be divided into three classes, with the classes being as nearly equal in number as possible and with one class being elected each year for a three-year term. ThePrior to January 24, 2023, the size of the Board is currentlywas set at ten. Threenine directors. On January 24, 2023, the Board expanded the size of the Board from nine to ten directors and elected Ms. Dio to fill the vacancy to serve as a Class I director until the 2023 Annual Meeting. On February 3, 2023, the Board expanded the size of the Board from ten to eleven directors and elected Mr. Dewbre to fill the vacancy to serve as a Class II Director until the 2024 Annual Meeting. Four Class I directors are to be elected at the 20202023 Annual Meeting to serve until the Annual Meeting of Stockholders in 2023 and one Class II director is to be elected at the 2020 Annual Meeting to serve until the Annual Meeting of Stockholders in 2021.2026.

Ms. Beder was elected to the Board in October 2019 as a Class I director. In January 2020, the Board decided to decrease the number of Class I directors from four to three effective in April 2020 and to increase the size of the Class II directors from three to four also effective in April 2020. It was determined that this change would affect Ms. Beder’s directorship. Therefore, Ms. Beder has been nominated for election as a Class II director.

Each nominee named below is currently serving as a director and, if elected, each has consented to serve for the new term, if elected.term. If any nominee becomes unable to serve as a director, an event currently not anticipated, the persons named as proxies in the enclosed proxy card intend to vote for a nominee selected by the present Board to fill the vacancy.

In addition to satisfying, individually and collectively, the Company’s Criteria for the Selection of Directors discussed under the “THE BOARD OF DIRECTORS — GovernanceESG and Nominating Committee” below, each of the directors has extensive experience with the Company or in a business similar to one or more of the Company’s principal businesses or the principal businesses of significant customers of the Company. The brief biographies of each of the nominees and continuing directors below include a summary of the particular experience and qualifications that led the Board to conclude that he or she should serve as a director.

14 | KIRBY | 2023 PROXY STATEMENT |

NOMINEES FOR ELECTION (PROPOSAL 1)

The Board of Directors of the Company unanimously recommends that you vote “FOR” the election of each of the following nominees as a director.

Nominees for Election as Class I directors, serving until the Annual Meeting of Stockholders in 20232026

| RICHARD J. ALARIO | ||

NOW, Inc.

Age:68 Independent Director since2011 Committees: • ESG and Nominating, Chair • Compensation

|

• Chairman of the Board (April 2021-present), Director (May 2014-present), Interim Chief Executive Officer (November 2019-June 2020); Interim Executive Vice Chairman (June 2020-October 2020), NOW, Inc. • Chairman of the Board and • Vice President, • Served for over 21 years in various capacities, most recently Executive Vice President, of OSCA, Inc., also an oilfield service Education • BA, Louisiana State University Other Boards/Organizations • NOW, Inc., Chairman of the

• Key Energy Services, Inc., Chairman of the Board (2004-2016) • National Ocean Industries Association, former Chairman Qualifications • Mr. Alario has over 35 years of experience in • His experience as an executive, including Chief Executive Officer, in oilfield service companies, has provided Mr. Alario | |

KIRBY | 2023 PROXY STATEMENT | ||

15 |

| SUSAN W. | ||

Committees: • None

|

• Chairman and President, BP America Inc. (2018-2020) • Chief Executive Officer, BP Shipping (2015-2018) • Head, Audit, Refining and Marketing, BP (2013-2015) • Served for over 36 years at BP in global, technical, operational roles Education • BS, Chemical Engineering – University of Mississippi Other Boards/Organizations • Britannia Steam Ship Insurance Associations, Ltd. (2018-2020), Independent Director • Oil Companies International Marine Forum (2018-2020), Director and Vice-Chair • Tanker Owners Pollution Federation Limited, Director and Advisory Committee Member • Methodist Hospital – The Woodlands, Director • Irving Oil Board, Director (2021-present) Qualifications • Ms. Dio has • Her experience as an executive, including Chief Executive Officer, has provided Ms. Dio with expertise in Risk Management, Operational Management, Marine Transportation, Safety Policies and Programs, Finance and Public Policy. | |

16 | KIRBY | 2023 PROXY STATEMENT |

| DAVID W. GRZEBINSKI | ||

President and CEO, Kirby Corporation Age:61 Director since2014 Committees: • None | Experience • President and Chief Executive Officer • Served in various operational and financial positions, • Employed by The Dow Chemical Company in manufacturing, engineering, and financial Education • BS, Chemical Engineering, University of South Florida • MBA, Tulane University • Chartered Financial Analyst Other Boards/Organizations • The Coast Guard Foundation, • American Bureau of

Qualifications • Mr. Grzebinski has primary responsibility for the business and strategic direction of the Company and is an essential link between the Board and the Company’sday-to-day operations. He has overall knowledge of all aspects of the Company, its operations, customers, financial condition, and strategic planning. His experience at Kirby provides expertise in critical areas including Marine Transportation, Petrochemicals and Refining, Oilfield Services and Hydrocarbon Transportation, as well as Risk Management and Environmental, Safety Policies and Programs. • Through his service at FMC and Dow, he has gained expertise in Public Policy, Finance and Science, Engineering and Technology. | |

KIRBY | 2023 PROXY STATEMENT | 17

|

| RICHARD R. STEWART | ||

since2008 Committees: • Audit, Chair

|

• President and Chief Executive Officer, • Served in various positions, Education • BBA in Finance, University of Other Boards/Organizations • Eagle Materials Inc., member of its Audit

• Exterran Corporation (2015-2018) Qualifications • During a35-year business career, Mr. Stewart has been the principal executive officer with both operating and financial responsibility for the diesel engine and gas turbine power and service businesses at Stewart & Stevenson and then at GE Aero Energy. Mr. Stewart’s extensive experience in the engine and power products business and expertise in Oilfield Services is valuable to the Board in its oversight of the Company’s distribution and services business and complements the marine transportation and petrochemical industry experience of a number of the Company’s other directors. • Mr. Stewart’s extensive career has also provided him with expertise in Risk Management, Environmental, Safety Policies and Programs and Finance. | |

18 | ||

KIRBY | | ||

NOMINEE FOR ELECTION (PROPOSAL 2)Directors Continuing in Office

The Board of Directors of the Company unanimously recommends that you vote “FOR” the election the following nominee as a director.

Nominee for Election asContinuing Class II director,directors, serving until the Annual Meeting of Stockholders in 20212024

| TANYA S. BEDER | ||||

|

Age:67 Independent Director since2019 Committees: • Audit • ESG and Nominating | Experience • Founder, Chairman, Chief Executive Officer and Head of the global strategy, risk, fintech and asset management • Held senior roles • Held various positions with The First Boston Corporation (now Credit Suisse) where she was a derivatives trader and was on the mergers and acquisitions team in New York and • Ms. Beder • Holds a CERT certification in Cybersecurity Oversight from the National Association of Corporate Directors Education • BA in Mathematics and Philosophy, Yale University • MBA, Harvard Business School Other Boards/Organizations • Nabors Industries, Chair of the Compensation Committee, a qualified financial expert on the • American Century Investments, • Mathematical Finance Advisory Board at New York • Columbia University Financial Engineering Program, • Institute for Pure and Applied Mathematics at

Qualifications • Ms. Beder brings to the Board extensive asset management experience providing expertise in Finance, vast knowledge of operational and • She has Academia experience through her time as a Fellow In Practice at Yale and lecturer in Public Policy at Stanford, and her service on various university advisory boards. She also provides Science, Engineeringand Technology expertise. | ||

KIRBY | 2023 PROXY STATEMENT | ||

19 |

Directors Continuing in Office

The following persons are directors of the Company who will continue in office.

Continuing Class II directors, serving until the Annual Meeting of Stockholders in 2021

| BARRY E. DAVIS | ||

since2015 Committees: • Compensation, Chair • Audit

|

• Chairman • President and Chief Executive Officer, Crosstex Energy (1996-2014 when EnLink Midstream • Held management roles with other companies in the energy industry Education • BBA in Finance, Texas Christian University Other Boards/Organizations • EnLink Midstream, Chairman (2014-2022) • Crosstex Energy (2002-2014) • Natural Gas and Electric Power Society, • Dallas Wildcat

• Texas Christian University, Board of Trustees Qualifications • Mr. Davis has extensive knowledge and experience in Hydrocarbon Transportation, which is the primary business of EnLink Midstream and its predecessors. EnLink Midstream provides midstream energy services, including gathering, transmission, processing, fractionation, brine services and marketing of natural gas, natural gas liquids, condensate, and crude oil. EnLink Midstream’s assets include an extensive pipeline network, processing plants, fractionation facilities, storage facilities, rail terminals, barge and truck terminals, and an extensive fleet of trucks. | |

|

| |

20 | ||

KIRBY | | ||

| ROCKY B. DEWBRE | ||

President and COO, Mansfield Service Partners

Committees: • None | Experience • President and COO, Mansfield Service Partners (2020-Present) • Chief Executive Officer, Empire Petroleum Partners, LLC (2017-2019) • Executive Vice President, Sunoco LP, (2014-2015) • Chief Executive Officer, Susser Petroleum Partners (2013-2014) • Chief Operating Officer, Susser Petroleum Partners (1999-2013) • Served for over 35 years in various capacities, most recently President & COO, Mansfield Service Partners, a lubricant and fuels distributor Education • BBA, Accounting and Management Information Systems, Texas Tech University • MBA, University of Texas Other Boards/Organizations • Core-Mark Holding Company, Inc. (2019-2021), Director • CST Brands, Inc. (2016-2017), Director • National Association of Corporate Directors (NACD) 2016 – Pres. • National Association of Publicly Traded Partnerships (NAPTP) 2012 – 2015 • Society of Independent Gasoline Marketers (SIGMA), Director (2010 – 2013) Qualifications • Mr. Dewbre has over 30 years of executive and board experience in public and private businesses in the energy, distribution, and multi-unit retail sectors. That experience is valuable to the Board in its oversight of the Company’s distribution and services business which serves the oilfield services industry as a significant part of its customer base. • His experience as an executive, including Chief Executive Officer, in motor fuels and lubricants distributor companies, has provided Mr. Dewbre with expertise in Risk Management, Cybersecurity, Environmental, Safety Policies and Programs and Finance. • Mr. Dewbre was appointed to the Board pursuant to a Cooperation Agreement entered into by and among the Company and JCP Investment Management, LLC and certain of its affiliates and associates. | |

KIRBY | 2023 PROXY STATEMENT

|

21 |

| JOSEPH H. PYNE | ||

Chairman of the Board Age:75 Director since1988 Committees: • None | Experience • Chairman of the Board

• He served at Northrop Services, Inc. and served as an Officer in the Navy Education • BA, University of North Carolina Other Boards/Organizations • DHT Holdings, Inc., Chair of the Compensation Committee and a member of the Nominating and Corporate Governance Committee (2015-present) • Genesee & Wyoming Inc., former director and member of the Compensation Committee Qualifications • Prior to his retirement, Mr. Pyne had been an employee of the Company for 40 years. Mr. Pyne has extensive knowledge of all aspects of the Company, its history, operations, customer base, financial condition, and strategic • He has long been active in industry associations that, among other benefits, monitor significant legislative and regulatory developments affecting both the marine transportation and distribution and services | |

22 | KIRBY | 2023 PROXY STATEMENT |

Continuing Class III directors, serving until the Annual Meeting of Stockholders in 20222025

| ANNE-MARIE N. AINSWORTH | ||

since2015 Committees: • Audit • ESG and Nominating

|

• President and Chief Executive Officer, • Senior Vice President of Refining, • General Manager of • Director of • Adjunct Professor, Rice University (2000-2009) Education • BS in Chemical Engineering, University of Toledo • MBA, Rice University • Graduate, Institute of Corporate Directors Education Program (Rotman School of Management, University of • Holds the ICD.D

Other Boards/Organizations • Pembina Pipeline Corporation, member of its Safety, Environment & Operational Excellence Committee and its HRH & Compensation Committee (2014 – present) • HF Sinclair, Chair of the Environmental, Health, Safety, and Public Policy Committee and a member of its Finance Committee (2017 – present) • Archrock, Inc., Chair of its Nominating and Corporate Governance Committee and a member of its Audit Committee (2015 – present) Qualifications • Ms. Ainsworth • Her industry experience also gained her expertise in Risk Management, Cybersecurity, Environmental, Safety Policies and Programs, Public Policy, Finance and Science, and Engineering and Technology. Ms. Ainsworth also has | |

KIRBY | 2023 PROXY STATEMENT | ||

23 |

| WILLIAM M. WATERMAN | ||

since2012 Committees: • Compensation • ESG and Nominating

|

| |

|

Education • BA in Economics, Union College in Schenectady, New York Other Boards/Organizations • The American Waterways Operators, the national trade association for the United States barge

Qualifications • Mr. Waterman has over 36 years of experience in the coastal tank barge business with Penn and its predecessor companies, building Penn into one of the largest coastal tank barge operators in the United States. Mr. Waterman’s extensive experience in that business and knowledge of its markets and customers have provided him expertise in Marine Transportation and Hydrocarbon Transportation which are valuable to the Board in its oversight of the Company’s coastal business and complement the inland marine transportation, midstream energy services, and petrochemical industry experience of other Company • Further, his time at Penn has provided him with expertise in Environmental, Safety Policies and Programs, Public Policy and Finance. | |

24 | ||

KIRBY | | ||

| SHAWN D. WILLIAMS | ||

Executive Chairman, Covia Holdings Age:59 Independent Director since2021 Committees: • ESG and Nominating | Experience • Executive Chairman of the Board (January 2022-present); Chief Executive Officer (June 2021-Dec. 2021), Chairman of the Board (Dec. 2020-Dec. 2021), Covia Holdings LLC, a provider of minerals-based solutions serving the industrial and energy markets • Chief Executive Officer, Nexeo Plastics Holdings, Inc., a global plastics distributor, (2019-2020) • Executive Vice President-Plastics (2017-2019); SVP-Plastics (2012-2017), Nexeo Solutions, Inc. • President, Momentive Global Sealants, a global specialty sealants business, President, Momentive Performance Materials, a silicone specialty materials business (2007-2012) • Spent 22 years working in leadership roles leading a variety of industrial and material businesses globally, General Electric Company Education • BS in Engineering, Purdue University • MBA, University of California, Berkeley • Holds a CERT certification in Cybersecurity Oversight from the National Association of Corporate Directors Other Boards/Organizations • Covia Holdings LLC, Chairman and member of the Audit and Compensation Committees (2020-present) • TETRA Technologies, Inc., member of its Audit Committee and Human Capital Management and Compensation Committee (2021-present) • Marathon Oil Corporation, member of its Audit and Finance Committee and Corporate Governance and Nominating Committee (February 2023-present) Qualifications • Mr. Williams has over 30 years of experience in executive and managerial positions in the United States and global industrial markets. Mr. Williams’ extensive experience in various industrial markets, and his expertise in Petrochemicals and Refining, Oilfield Services and Environmental, Safety Policies and Programs is valuable to the Board in its oversight of the Company’s distribution and services business and complements the marine transportation and petrochemical industry experience of a number of the Company’s other directors. • His extensive career, including as Chief Executive Officer, has provided him with experience in Risk Management, Cybersecurity, Finance and Science, Engineering and Technology. | |

KIRBY | 2023 PROXY STATEMENT | 25 |

THE BOARD OF DIRECTORS

The Company’s business is managed under the oversight and direction of the Board, which is responsible for strategic oversight, broad corporate policy, and for monitoring the effectiveness of Company management. Members of the Board are kept informed about the Company’s businesses by participating in meetings of the Board and its committees, through operating and financial reports made at Board and committee meetings by Company management, through various reports and documents sent to the directors for their review and by visiting Company facilities. The Board’s development includes onsite meetings at key operating facilities which include interaction with employees at those locations.

The NYSENew York Stock Exchange (“NYSE”) listing standards require listed companies to have at least a majority of independent directors. For a director to be considered independent, the Board must determine that the director does not have any direct or indirect material relationship with the Company.

The Board has determined that the following incumbent directors have no relationship with the Company except as directors and stockholders and are independent within the meaning of the NYSE corporate governance rules:listing standards:

| Anne-Marie N. Ainsworth | Richard R. Stewart | |||||||

| Richard J. Alario | Susan W. Dio | William M. Waterman | ||||||

Rocky B. Dewbre | Shawn D. Williams | |||||||

While Mr. Pyne is not disqualified under the NYSE’s objective director independence tests, the Board has determined that he is not independent considering all relevant facts and circumstances of his relationship with the Company.

Our Chief Executive Officer, Mr. Grzebinski, has certified to the NYSE that the Company is in compliance with NYSE corporate governance listing standards.

The Board carries out itsis responsible for the risk oversight function throughand has designated the Audit Committee, the Compensation Committee, and the full Board. ManagementESG and Nominating Committee certain responsibilities to provide assistance in fulfilling the Board’s responsibilities. The Board seeks to align risk oversight with its disclosure controls and procedures, and a particular risk will be monitored and evaluated by another Board committee with primary responsibility in the area of the subject matter involved. For example, the Compensation Committee reviews the risks related to the Company’s compensation policies and practices and the Audit Committee receives regular reports and updates on cybersecurity issues. On a quarterly basis, management prepares and reviews with the Audit Committee and the Board semiannuallythe risks outlined in the Company’s most recent Annual Report on Form 10-K, any new risks identified in the Company’s most recent Quarterly Report on Form 10-Q, and annually a comprehensive assessment of the identified internal and external risks of the Company that includes evaluations of the potential impact of each identified risk, its probability of occurrence and the effectiveness of the controls that are in place to mitigate the risk. The Audit Committee and the Board also receive regular reports of any events or circumstances involving risks outside the normal course of business of the Company. At times, a particularThe ESG and Nominating Committee oversees the Company’s ESG programs, including climate change risk, will be monitoredas well as the Corporate Sustainability report, TCFD, and evaluated by anotherSASB disclosures. The Board committee with primaryand its committees also review potential emerging risks as they seek to anticipate future threats and trends that may impact the Company. Management and, where appropriate, internal and external experts provide reports on risks in their respective areas of responsibility inor expertise. Frequency of updates and discussion of risks varies depending on the areaimmediacy or severity of the subject matter involved. For example, the Compensation Committee reviews therisk, with more immediate or severe risks related to the Company’s compensation policiesbeing updated and practices and the Audit Committee receives regular reports and updates on cybersecurity issues. The Board’s administration of its risk oversight function has not affected the Board’s leadership structure.reviewed more frequently.

The Board has no set policy concerning the separation of the offices of Chairman of the Board and Chief Executive Officer, but retains the flexibility to decide how the two positions should be filled based on the circumstances existing at any given time. Following Mr. Grzebinski’s succession to the position of President and Chief Executive Officer in 2014, the Board considered it important for Mr. Pyne, with his comprehensive understanding of the Company’s businesses and strategic direction, to continue in the role of an executiveExecutive Chairman of the Board. During the same time period, the Board was focused on management succession planning, primarily for the role of Chief Executive Officer but also for other senior management positions. The Board determined that having Mr. Pyne continue to serve as an executiveExecutive Chairman of the Board after relinquishing the role of Chief Executive Officer would facilitate the succession process and provide valuable support to the senior management team. When Mr. Pyne

26 | KIRBY | 2023 PROXY STATEMENT |

retired as Executive Chairman of the Board in April 2018, the Board considered it important to the Company for Mr. Pyne to continue as Chairman of the Board in anon-executive capacity to continue to take advantage of his knowledge of the Company and its businesses as well as his leadership experience and he continues to serve in such capacity.

The Board does not have a lead director, but has chosen Mr. Alario to be the presiding directorLead Independent Director to preside at the regular executive sessions of thenon-management directors that are held at least quarterly. An executive session with only independent directors is held at least once per year. Mr. Alario also serves as a liaison between the independent directors and management on certain matters that are not within the area of responsibility of a particular committee of the Board.

The Board has established three standing committees, including the Audit Committee, the Compensation Committee, and the Governance Committee, each of which is briefly described below.

ESG and Nominating Committee. All of the members of the Audit Committeeeach committee are independent, as that term is defined in applicable Securities and Exchange Commission (“SEC”)SEC and NYSE rules. In addition,The member composition and a brief description of the principal functions of each committee is briefly described below.

Board Member | Member Type | Audit Committee | Compensation Committee | ESG and Nominating Committee | ||||

Anne-Marie N. Ainsworth | Independent | M | M | |||||

Richard J. Alario | Lead Independent | M | C | |||||

Tanya S. Beder | Independent | M | M | |||||

Barry E. Davis | Independent | M | C | |||||

Rocky B. Dewbre(1) | Independent | |||||||

Susan W. Dio(1) | Independent | |||||||

Richard R. Stewart | Independent | C | ||||||

William M. Waterman | Independent | M | M | |||||

Shawn D. Williams | Independent | M | ||||||

| (1) | Mr. Dewbre and Ms. Dio have not yet been assigned to a committee |

C – Committee Chairperson

M – Committee Member

Audit Committee

The Board has determined that all of the members of the Audit Committee are “audit committee financial experts,” as that term is defined in SEC rules. The Audit Committee operates under a written charter adopted by the Board. A copy of the charter is available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Governance/Governance Overview.Documents.

PRINCIPAL FUNCTIONS |

| |

Monitor the Company’s financial reporting, accounting procedures, and systems of internal |

| |

Select the independent auditors for the Company | ||

Review the Company’s audited annual and unaudited quarterly financial statements with management and the independent auditors | ||

Monitor the independence and performance of the Company’s independent auditors and internal audit function | ||

Monitor the Company’s compliance with legal and regulatory requirements | ||

Review with management the Company’s policies with respect to risk assessment and risk management, including review of cybersecurity processes, procedures, and safeguards |

KIRBY | 2023 PROXY STATEMENT | 27 |

Compensation Committee

All of the members of the Compensation Committee are independent, as that term is defined in applicable SEC and NYSE rules. In addition, all of the members of the Compensation Committee are“Non-Employee Directors” and “outside directors” as defined in relevant federal securities and tax regulations. The Compensation Committee operates under a written charter adopted by the Board. The Committee oversees compensation for Kirby’s senior executives (including salary, bonus, and performance share awards), as well as succession planning for key executive positions. A copy of the charter is available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Governance/Governance Documents.

PRINCIPAL FUNCTIONS |

Determine the compensation of executive officers of the Company |

Reviews and approves the corporate goals and objectives |

Administer the Company’s annual incentive bonus program |

Administer the Company’s stock option, restricted stock, restricted stock units (“RSUs”), and long-term incentive plans and grant stock options, restricted stock, RSUs, and cash performance awards under such plans |

Reviews and approves the Compensation Discussion and Analysis (“CD&A”) and recommends to the Board the inclusion of the CD&A in the proxy statement |

ESG and Nominating Committee

The ESG and Nominating Committee operates under a written charter adopted by the Board. A copy of the charter is available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Governance/Governance Overview.Documents.

PRINCIPAL FUNCTIONS |

| |

|

| |

| ||

|

All of the members of the Governance Committee are independent, as that term is defined in NYSE rules. The Governance Committee operates under a written charter adopted by the Board. A copy of the charter is available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Governance/Governance Overview.

|

| |

|

| |

Review all related person transactions | ||

Oversee the operation and effectiveness of the Board | ||

Lead the annual review of the Board and management performance, including the CEO

| ||

The GovernanceESG and Nominating Committee will consider director candidates recommended by stockholders or proposed by stockholders in accordance with the Company’s Bylaws. Recommendations may be sent to the Chairman of the GovernanceESG and Nominating Committee, Kirby Corporation, P.O. Box 1745, Houston, Texas 77251-1745, accompanied by biographical information for evaluation. The Board of the Company has approved Criteria for the Selection of Directors which the GovernanceESG and Nominating Committee will consider in evaluating director candidates. The criteria address compliance with SEC and NYSE requirements relating to the composition of the Board and its committees, as well as character, integrity, experience, understanding of the Company’s business, and willingness to commit sufficient time to the Company’s business. The criteria are available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Governance/Governance Overview.Documents.

In addition to the above criteria, the Governance Committee and the Board will consider diversity in business experience, professional expertise, gender and ethnic background in evaluating potential nominees for director. The Company’s Corporate Governance Guidelines and GovernanceESG and Nominating Committee Charter include provisions concerning the consideration of diversity in business experience, professional skills, gender, race, and ethnic background in selecting nominees for director. The GovernanceCompany and ESG and Nominating Committee are committed to having a Board that reflects diverse perspectives and actively seeks out highly qualified candidates that include women and individuals from minority groups when board nominees are chosen. The ESG and Nominating Committee took these provisions into account in expandingelecting new members to the Board last year.in 2019, 2021 and 2023.

When there is a vacancy on the Board (i.e., in cases other than the nomination of an existing director for reelection), the Board and the GovernanceESG and Nominating Committee have considered candidates identified by executive search firms, candidates recommended by stockholders and candidates recommended by other directors. The GovernanceESG and Nominating Committee will continue to consider candidates from any of those sources when future vacancies occur. The GovernanceESG and Nominating Committee does not evaluate a candidate differently based on whether or not the candidate is recommended by a stockholder.

28 | KIRBY | 2023 PROXY STATEMENT |

Attendance at Meetings

It is the Company’s policy that directors are expected to attend Board meetings and meetings of committees on which they serve and are expected to attend the Annual Meeting of Stockholders of the Company. During 2019,2022, the Board met fournine times, the Audit Committee met eight times, the Compensation Committee met five times and the GovernanceESG and Nominating Committee met fourfive times. Each director then serving attended allmore than 90% of the aggregate number of the meetings of the Board and more than 75% of the aggregate number of meetings ofall the committees on which he or she served. All directors then serving attended the 20192022 Annual Meeting of Stockholders of the Company.

Directors who are employees of the Company receive no additional compensation for their service on the Board. Compensation of nonemployee directors is determined by the full Board, which may consider recommendations of the Compensation Committee. Past practice has been to review director compensation when the Board believes that an adjustment may be necessary in order to remain competitive with director compensation of comparable companies. Management of the Company periodically collects published survey information on director compensation for purposes of comparison.

Each nonemployee director receives an annual fee of $75,000. A director may elect to receive the annual fee in cash, stock options or restricted stock. The Chairman of the Board receives an additional annual fee of $150,000, the Chairman of the Audit Committee receives an additional annual fee of $20,000, the Chairman of the Compensation Committee receives an additional annual fee of $15,000, and the Chairman of the GovernanceESG and Nominating Committee receives an additional annual fee of $10,000. The lead independent director or presiding director at executive sessions of thenon-management directors receives an additional annual fee of $20,000. In addition, each director receives an annual fee of $7,500 for each committee of the Board on which he or she serves. All fees are payable in four equal quarterly payments made at the end of each calendar quarter. The annual director fee is prorated for any director elected between annual stockholder meetings and the Chairman of the Board, committee chairman, lead independent or presiding director, and committee member fees are prorated for any director who is elected to such position between annual meetings of the Board. Directors are reimbursed for reasonable expenses incurred in attending meetings.

Each nonemployee director will receive a fee of $3,000 for each board meeting attended, in person or by telephone, in excess of six meetings in any one calendar year. Each member of a committee of the board will receive a fee of $3,000 for each committee meeting attended, in person or by telephone, in excess of ten meetings in any one calendar year in the case of the Audit Committee, in excess of eight meetings in any one calendar year in the case of the Compensation Committee and in excess of eight meetings in any one calendar year in the case of the GovernanceESG and Nominating Committee.

In addition to the fees described above provided to the directors, the Company has a stock award plan for nonemployee directors of the Company which provides for the issuance of stock options and restricted stock. The director plan provides for automatic grants of restricted stock to nonemployee directors after each annual meeting of stockholders. Each director receives restricted shares of the Company’s common stock after each annual meeting of stockholders. The number of shares of restricted stock issued is equal to (a) $167,500 divided by (b) the fair market value of a share of stock on the date of grant multiplied by (c) 1.2. The director plan also provides for discretionary grants of up to an aggregate of 10,000 shares in the form of stock options or restricted stock. In addition, the director plan allows for the issuance of stock options or restricted stock in lieu of cash for all or part of the annual director fee at the option of the director. A director who elects to receive stock options in lieu of the annual cash fee will be granted an option for a number of shares equal to (a) the amount of the fee for which the election is made divided by (b) the fair market value per share of the common stock on the date of grant multiplied by (c) 3. A director who elects to receive restricted stock in lieu of the annual cash fee will be issued a number of shares of restricted stock equal to (a) the amount of the fee for which the election is made divided by (b) the fair market value per share of the common stock on the date of grant multiplied by (c) 1.2. The exercise price for all stock options granted under the director plan is the fair market value per share of the Company’s common stock on the date of grant. The restricted stock issued after each annual meeting of stockholders vests six months after the date of issuance. Stock options granted and restricted stock issued in lieu of cash director fees vest in equal quarterly increments during the year to which they relate. The stock options generally remain exercisable for ten years after the date of grant.

The Board has established stock ownership guidelines for officers and directors of the Company. Nonemployee directors must be in compliance within five years after first election as a director, but are expected to accumulate the required number of shares ratably over the applicable five-year period. Under the guidelines, nonemployee directors are required to own common stock of the Company having a value equal to four times the annual cash director fee. As of December 31, 2019,2022, all directors were in compliance with the stock ownership guidelines. The GovernanceESG and Nominating Committee of the Board will monitor compliance with the guidelines and may recommend modifications or exceptions to the Board.

KIRBY | 2023 PROXY STATEMENT | ||

29 |

The following table summarizes the cash and equity compensation for nonemployee directors for the year ended December 31, 2019:2022:

Director Compensation for 20192022

| NAME | FEES EARNED OR PAID IN CASH | STOCK AWARDS(1)(2) | OPTION AWARDS(1)(2) | TOTAL | FEES EARNED OR PAID IN CASH | STOCK AWARDS(1)(2) | OPTION AWARDS(1)(2) | TOTAL | ||||||||||||||||||||||||||||

Anne-Marie N. Ainsworth | $ | 82,500 | $ | 201,043 | $ | — | $ | 283,543 | $ | 99,000 | $ | 200,975 | $ | — | $ | 299,975 | ||||||||||||||||||||

Richard J. Alario | 120,000 | 201,043 | — | 321,043 | 129,000 | 266,895 | — | 395,895 | ||||||||||||||||||||||||||||

Tanya S. Beder | 18,750 | 100,528 | — | 119,278 | 99,000 | 200,975 | — | 299,975 | ||||||||||||||||||||||||||||

Barry E. Davis | 15,000 | 201,043 | 79,719 | 295,762 | 39,000 | 291,101 | — | 330,101 | ||||||||||||||||||||||||||||

C. Sean Day | 30,000 | 291,037 | — | 321,037 | ||||||||||||||||||||||||||||||||

Monte J. Miller | 90,000 | 201,043 | — | 291,043 | ||||||||||||||||||||||||||||||||

C Sean Day(3) | 22,500 | — | — | 22,500 | ||||||||||||||||||||||||||||||||

Joseph H. Pyne(4) | 224,076 | 201,043 | — | 425,119 | 234,000 | 200,975 | — | 434,975 | ||||||||||||||||||||||||||||

Richard R. Stewart | 102,500 | 201,043 | — | 303,543 | 111,500 | 200,975 | — | 312,475 | ||||||||||||||||||||||||||||

William M. Waterman | 26,250 | 291,037 | — | 317,287 | 24,000 | 291,101 | — | 315,101 | ||||||||||||||||||||||||||||

Shawn D. Williams | 86,625 | 200,975 | — | 287,600 | ||||||||||||||||||||||||||||||||

| (1) | The amounts included in the “Stock Awards” and “Option Awards” columns represent the grant date fair value related to restricted stock awards |

| (2) |

|

| (3) |

|

| (4) |

|

30 | ||

KIRBY| | ||

Director Outstanding Equity at December 31, 20192022 and Grant Date Fair Value of Equity Awarded During 20192022